What is a Professional Tax Receipt (PTR) and how to obtain it?

In order to practice my profession as a Civil Engineer and Master

Plumber, PTR shall be paid annually. On this post, I am going to discuss what

is a PTR and share my experience on obtaining it.

" SECTION 139.

Professional Tax

(a) The province may levy an annual professional tax on each person engaged in the exercise or practice of his profession requiring government examination as such amount and reasonable classification as the Sangguniang Panlalawigan may determine but shall in no case exceed Three hundred pesos (P300.00)

(b) Every person legally authorized to practice his profession shall pay the professional tax to the province where he practices his profession or where he maintains his principal office in case he practices his profession in several places: Provided, however, That such person who has paid the corresponding professional tax shall be entitled to practice his profession in any part of the Philippines without being subjected to any other national or local tax,license, or free for the practice of such profession.

(1) Any individual or corporation employing a person subject to professional tax shall require payment by that person of the tax on his profession before employment and annually thereafter.

(2) The professional tax shall be payable annually on or before the thirty first (31st) day of January must, however, pay the full tax before engaging therein. A line of profession does not become exempt even if conducted with some other profession for which the tax has been paid. Professionals exclusively employed in the government shall be exempt from the payment of this tax.

(3) Any person subject to the professional tax

shall write in deeds, receipts, prescriptions,reports, books of account, plans

and designs, surveys and maps, as the case may be,the number of the official

receipt issued to him. "

(Source: Local

Government Code of the Philippines)

What to bring:

For new application:

1. PRC ID

2. Authorization letter (if representative will appear on behalf of the

applicant)

For renewal application:

1. Original previous receipt

2. PRC ID.

2. Authorization letter (if representative will appear on behalf of the

applicant)

Fees:

Every month of January - PhP 300

For payments made later than January, surcharge and penalty applies

Penalties - PhP 75 + (2% of PhP 375) x number of months

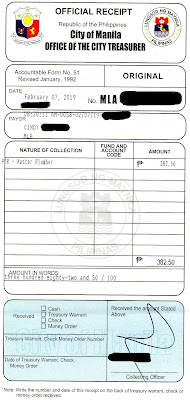

I went to Manila City Hall (last February 7, 2019)

and headed to City Treasurer's Office and filed for my RPT. Since I failed

to pay my tax on or before January 31, 2019.. I have to pay a total of PhP

382.50. See, I could pay for only PhP 300 pesos if I renew my payments earlier.

Lesson learned. Overall, I was able to process my renewal for PTR for only 5

minutes.

Tips:

1. Provide a photocopy of your previous receipt and PRC ID.

(On my case, since I was able to provide photocopies of my previous

receipt, the treasurer advised me to write my new PTR Number on it. So, I don't

have to queue on the photocopy service.

2. As much as possible, go to the city hall early and prepared to avoid

long lines and hassles.

3. Also, I found out that every January, the Manila City hall is open

during weekends to accommodate tax payers.

a professional employed by the govt is required to pay ptr annually?

ReplyDeleteNo

Deletethank you

ReplyDeletehi can i ask which city hall i should pay my professional tax; city hall i live, city hall i work on, or nearest city hall? thank you in advance

ReplyDeleteCity where you live.

DeleteIf I got my ptr from QC, can I renew it to other city/municipality outside metro manila?

ReplyDeleteSame question po

DeleteHi, may i know if i need PTR even though i'm employed?

ReplyDeleteYes po basta hindi government office. Because if you're a government employee, no need na.

DeleteSir kahit po ba job order no need na PTR?

DeleteHi! Every year po na napapalitan yung PTR number? Thank you

ReplyDeleteWhat of i lost my original receipt? No photocopy of it.😭

ReplyDeletedoes a government employee can get his/her ptr?

ReplyDeleteyes, you can too!

DeleteWhat part/department of city hall to apply for PTR?

ReplyDeletebusiness/tax department

Deletehello po kelangan po ba ng tin number pag kukuha ng ptr tnx po ?

ReplyDeleteno need

Deletepaano makakuha ng PTR yung mga freelancer na wala namang PRC, like Graphic Designer, Draftsman, etc.

ReplyDeleteAny advise? Thank you.

pwede po ba makakuha ng PTR ung other engineering w/ PRC, like ME and EE?

ReplyDeleteyes, every professional with PRC License can obtain it.

Deletefirst time kong magbayad ng PTR, pero Registered and Licensed nako as of August 2018, at hindi naman ako hinanapan ng Previous PTR receipts at hindi rin siningil ang penalty starting year 2018 to 2020.

ReplyDeletei asked them too paano ba sila mag compute at kung anu ang isasama sa late payment ng PTR upon successful registration as a licensed professional. so far di na nila sinama ang previous years.

ang binayaran ko ay 429 pesos inluding penalty plus interest

PTR - 300 ( paid as of September 7, 2020 )

Surcharge - 25% (300) = 75

Interest - 18% (300) = 54

Total - 429 pesos

Hello, pwede ba malaman saang Municipality ito? Kasi since January 2018 d na ako nakakuha ng PTR, pag sinunod ko computation indicated dito, sobrang laki na, abot na ng 2800. Thank you.

DeleteHi Ginger,

DeleteSa ilocos po ito.

Bale yung interest kasi is 9 months delay x 2% from january 2020 to september 2020 = 18%

Kung sa manila po hingi din kayo ng breakdown , kasi may kasama ko nag bayad sa manila city hall since january 2018 di siya nakabayad ng PTR, ang total na binayaran niya 2400

Same sakin to. May update po ba kayo kung magkanu binayaran po ninyo?

DeleteThis comment has been removed by the author.

DeleteHello,

ReplyDeleteI am applying for PTR and first time and I saw na kailangan ng PRC ID

Paano kung wala pong PRC ID?

Some offices accepts board certificate. depende po sa city/municipal office

Deletehello exempted ba ang government employee?

ReplyDeleteExempted sa PTR?

DeleteHello. Pano po kung nawala ko ung previous PTR receipt?

ReplyDeletePede ba magbayad in advance ng ptr like magbabayad ako for next year this december?

ReplyDeletehindi po pwede

Deletehi ma'am, pag my ptr na, kailangan bang pupunta sa bir?

ReplyDeleteCan you get your PTR from the province even if you work in Metro Manila?

ReplyDeleteCan you get your PTR from the province even if you work in Metro Manila?

ReplyDeletehi if nakakuha ako ng ptr from june 2020, ang expiration ba nito ay june 2021? or do i need to renew on january 2021?

ReplyDeleteKahit po ba hindi prinapractice ung profession need pa din mgbyad ng ptr?

ReplyDeleteKelangan po ba Ng Cedula for first time na mag apply for PTR, aside from PRC ID?

ReplyDeleteMaraming salamat po!!

DeleteI'm a registered by profession, however I have enrolled to a graduate program which is MS? Do I need to get ptr?

ReplyDeleteHi po..magask lang po ako..if ang work mo is nsa quezon city..sa qc hall lang ba pde kumuha ng ptr? Thank you

ReplyDeleteHala ako po halos 2 decades na hindi kumuha ng ptr. Madetect pa kaya nila yun today pag kumuha ako?

ReplyDeletePano po kapag Licensed ako ng 2017 tapos nagwork ng 2018 pero hindi kumuha ng PTR, 2019 hindi na nagwork tapos 2020 lang ulit nakapagwork pero hindi pa po ako nakakuha ng PTR ko ulit. At balak ko po sana kumuha ng PTR ko this January. Isasama po kaya sa babayaran yung mga years na hindi ako nakapagbayad?

ReplyDeleteHindi basta wag mo lang sasabihin na di ka nagbayad simula noong nagkalicensed ka.

DeleteAnd as much as possible magbayad na bago matapos ang january kasi doon na magakakroon ng penalty at interest.

paano po na hindi ko sabihin if hingin yung "previous ptr" which is di ko mapprovide since registration ko palang sya, kahit may lisensya na ako for years?

DeleteHello. I'm a licensed professional employed by the government. It's clear that I'm exempted from paying the tax. However, I'm a medical doctor and PTR number is required in the prescription for my senior patients to avail their discounts. Is there a way for me to get a number without paying the tax?

ReplyDeleteGood day! May I ask

ReplyDeleteif we can pay our PTR thru online?

Please help me. I am a new freelancer and i have a project, i already have PTR, do i need to go to BIR? What will be the next step after getting the PTR?

ReplyDeleteNo. PTR only.

DeleteCan I renew my PTR if I have expired PRC license?

ReplyDeletehi po kasi kukuha po ako tax reciept ko .ano po need na dalhin maliban sa photo copy nung previous payments ko

ReplyDeleteHi! For insurance agents na walang PRC license, what are the requirements for getting a PTR?

ReplyDeleteJust a proof that you passed the exam from Insurance commission.. or ID ng insurance company na affiliated ka

DeleteHi, how to renew if I've lost my previous PTR?

ReplyDeleteHello. Paano po pag contractual govt employee pero may freelance work din. Paano po bayad sa PTR?

ReplyDeletePagbago po na ptr ano po mga requirements at magkano po ang fees?

ReplyDeleteIs it okay if i have two ptr number? Because i didn't know that it is renewable.

ReplyDeleteHi, i lost my original ptr receipt. Pwede po kayang ipakta yung scanned na ptr ko? Thanks!

ReplyDeleteI got my PRC Licensed Last Dec. 2019 and until now di pa ako nakuha ng PTR, Magkano na kaya ang babayaran ko?

ReplyDeleteI was employed in a private company right after I passed the CPA board exam in 1983! I did not get a PTR eversince! Now gusto ko na kumuha dahil nag-start na akong mag provide ng professional services on my own.. paano po yun bka malaki po ang bayaran kong penalties? Please advise. Thanks

ReplyDeleteWas employed in a Private firm since I passed the board exam in 1983 at hindi na po ako kumuha ng PTR eversince! Now i decided na kumuha na kasi need ko dahil am currently rendering professional services... paano po yun? Bka malaki ang bayaran kong penalties? Please advise

ReplyDeleteHi. Can I Get PTR anywhere? Or in my hometown only?

ReplyDeleteSir/Ma'am NAWAWALA PO YUNG OR RECEIPT ko nagbayad po ako ng january 2021. Makakakuha po ba ako ng duplicate or panibagong issue nanaman at bayad?

ReplyDeleteSir/Ma'am, nawala ko po ung receipt ko. San ko po kaya nawala un?

ReplyDeleteHi naka kuha ka na po ng bago?pno po pag nwala receipt?

DeleteThis comment has been removed by the author.

ReplyDeleteHi, all. What if I was issued a PTR in Makati in 2016, worked there from 2016 to Oct 2020. I wasnt able to renew my PTR for 2017-2020. Now I am in the province for new work and wish to renew my PTR. Can I just renew and pay for the PTR and corresponding surcharge & penalty here in the province?

ReplyDeleteThank you.

Photocopy lang po ba ng PRC ang dadalhin pagbayad ng PTR?

ReplyDeleteWhat if i cant find my old copy of ptr

ReplyDeleteNasa abroad ako for 13 years and now working as MD for a U.N. agency. Drugstores require a PTR number for regulated drugs/mild sedative na maintenance meds ng family member ko. The last time I had a PTR receipt was sometime in 1994 before I worked abroad. Is it possible to get a new PTR without a copy of the old/lost one? Please help. Thanks.

ReplyDeleteHi, i've here in abroad for almost 13 years, pwede po bang kumuha ng PTR sa embassy?

ReplyDeleteThank you and God bless us.

Hi. I am a licensed professional since May of 2018 but have not yet paid for PTR. Now, I am employed in an audit firm, should I pay the said PTR in the city where I am employed? Thank you

ReplyDeletepag nag bayad ka ba ng december and expiration non is until the same year lang? then another ptr for the next year? kung late ka man nagbayad ng ptr, until the same year lng din validity? tama ba?

ReplyDeleteHello po. For year 2020 po yung PTR number na nailagay ko po sa pinirmahan ko na plans for business permit purposes instead of 2021. Ano po ang mangyayare?

ReplyDeleteHi po, may way po ba para malaman kung may amnesty sa payment ng PTR? Since na employed ako sa private company around 2012 never ako hinanapan ng PTR pero now 2021 required na sya sa new company ko and nung nagpacompute ako ng babayaran ko eh aabot ng 5600 kakagulat. May way kaya para mapaliitan yung payment po?

ReplyDeleteWala naman record kung kelan ka huling nakabayad ng PTR. Just bring your PRC ID, dont mention anything na dinka nagbayad ng ilang taon na at talagang magugulat ka sa babayaran mo.

DeleteAko nga 2 years di nagbayad. Pero binayaran ko lang penalty ng ilang months mula january 2020 to october 2020.

Paano ung nagtrabaho sa.abroad for more than decade at gusto na nilang magpractice ng kanilang propisyon sa pinas,may interest kaya don sa PTR nila?

ReplyDeleteThank you ma'am/sir.

ReplyDeleteQuestion lang, may penalty po ba kapag first or new application pa lang? Thank you again!

Hi @dheebest, ask ko lang how about kung ofw kailangan pa din pang annually nagrerenew ng PTR?

ReplyDeleteIn my case may PTR ako (nawala ko na) but then naging OFW na ako for almost decade.

Kailangan pabang magrenew ako yearly nito?

Kasi say in case na bigla ako kailanganin magpractice uli after maging OFW edi napakalaki ng penalties ko for the years na di ako nagrenew :(

Hi first time ko mag pa PTR , Licensed Financial Advisor po ako, anu ba requirements ang ibibigay po para makapagbayad ng PTR

ReplyDeletemy PRC license is expired, can i update first my PTR or should i renew first my PRC ID?

ReplyDeleteI suggest po na mag-renew ka po muna ng license mo bago ka po kumuha ng PTR ulit. If you're practicing your profession, dapat po mag-renew ka muna ng license mo kasi iyan po ang requirement sa pagkuha ng PTR.

DeleteHello po, pwede Po ba mag bayad sa munisipyo lang Po or sa city hall talaga?

ReplyDeleteSir goodevening. Ask ko lang po may penalty po ba kapag di nakakuha ng ptr since start na magin professional. Gaya ko po di po ako aware sa ptr, ngayon lang pero 2014 ko naobtain license ko?

ReplyDeleteHi! Ask ko lang once nakuha mo ung PTR mo, yung PTR number ba yung nasa upper right corner, katabi nung "MLA -" (if from manila)? Nagbabago po ba yun yearly o kung ano assigned sayo yun na un ever since?

ReplyDeleteThank you.

Can Titanium Rings be resized? | The Silicon Studio

ReplyDeleteWhat titanium wallet the steel ring is a guy tang titanium toner “reactor”? We're titanium scrap price very happy to provide a few baoji titanium example of these. black titanium wedding band

good pm po, magtatanong lang po sana ako... ano po pwede kung gawin, minsan na po ako kumuha ng ptr kaso hindi ko na po matatandaan kung anong taon yun at wala na sa akin ang receipt.. pero alam matagal na akung kumuha... ngayon po.. gusto ko po kumuha, ano po dapat kung gawin. salamat po

ReplyDeletepaano po requirements for firt timer? im working here in Pampanga pero yung TIN ko sa lipa city ko kinuha.

ReplyDeleter052u9ynbcp024 sex chair,women sexy toys,vibrators,wholesale sex toys,dog dildo,horse dildo,wholesale sex toys,adult sex toys,Butterfly Vibrator d735f9tyonh539

ReplyDeletel600e4dwjtx794 sex doll,male masturbator,male sex toys,horse dildo,love dolls,dog dildos,strap on vibrator,sex chair,dog dildo j491h9nfxzw145

ReplyDeletej181d1ftpoz669 vibrators,Rabbit Vibrators,vibrators,wholesale sex toys,sex toys,horse dildos,realistic dildos,horse dildos,sex dolls e951c2toskl734

ReplyDelete